- Home

- About

- Industries Served

- Capabilities

- Digital Transormation

- Business Transformation

- Cyber Security

- Sustainability Strategy Advisory

- ESG Disclosures

- Net Zero Carbon

- Article 6 and Carbon Pricing

- Low Carbon Solutions

- Climate Reduction Regulatory Compliance

- Nationally Determined Contributions

- Contract Catalyst

- Accreditation Advisory

- Management System

- People Strategy

- GRC

- Case Studies

- Resources

- News

- Contact

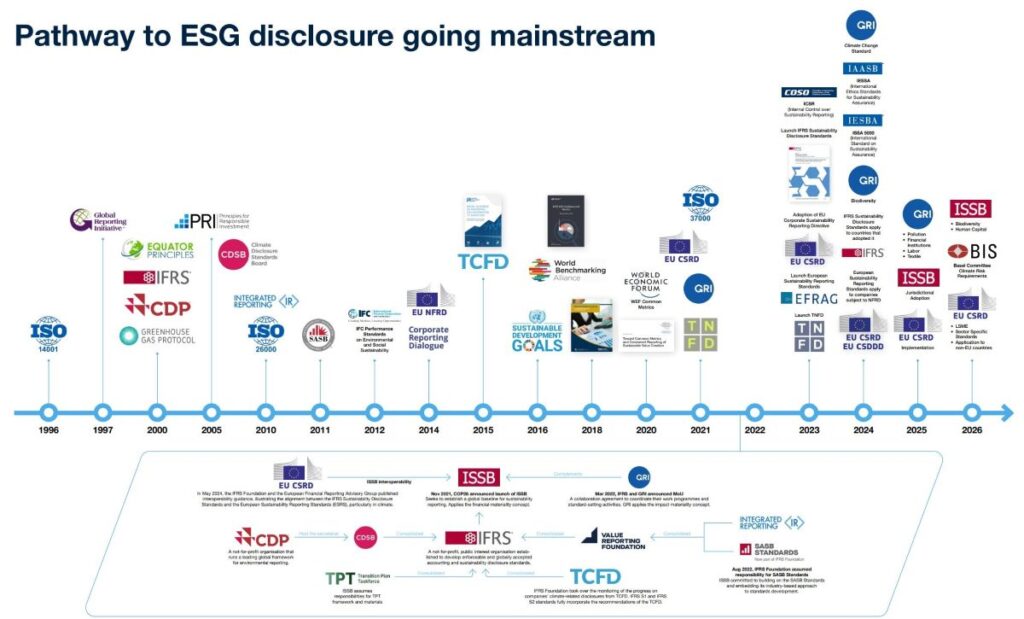

ESG Disclosures

- Home

- ESG Disclosures

ESG Disclosures

Our ESG Disclosures Advisory Services include

5.1 GRI Standards: Global Reporting Initiative

Overvew

Our Approach

Guide organizations in adopting GRI standards for sustainability reporting.

Support integration with existing management systems.

Assist in data collection and reporting processes, ensuring compliance with the GRI framework.

Impact to Customers

➺ Improved transparency and accountability in reporting.

➺ Enhanced stakeholder trust and engagement.

➺ Better alignment with global sustainability expectations.

5.2 ESRS E1 Compliance: European Sustainability Reporting Standards

Overvew

Our Approach

Support organizations in implementing ESRS E1 guidelines for sustainability reporting.

Provide solutions to help collect, analyze, and disclose the necessary sustainability data.

Ensure compliance with European regulations, particularly in logistics and transport sectors.

Impact to Customers

➺ Streamlined regulatory compliance.

➺ Enhanced visibility of sustainability performance in the European market.

➺ Improved transparency in sustainability practices.

5.3 IFRS S1 & S2 Guidelines: International Financial Reporting Standards for Sustainability Disclosures

Overvew

Our Approach

Guide companies through the adoption of IFRS S1 & S2 standards for environmental impact reporting.

Provide assistance in embedding sustainability data into financial reports.

Align corporate governance and financial transparency with global accounting standards.

Impact to Customers

➺ Improved integration of environmental impacts with financial disclosures.

➺ Enhanced credibility and compliance with international accounting standards.

➺ Better alignment with stakeholder expectations on sustainability practices.

5.4 TCFD Recommendations: Task Force on Climate-related Financial Disclosures

Overvew

Our Approach

Assist in aligning organizational strategies with TCFD guidelines.

Develop tailored reports for stakeholders on climate risks, opportunities, and governance processes.

Support implementation of risk assessment tools and climate-related financial disclosures.

Impact

➺ Increased credibility with investors and stakeholders.

➺ Better identification and management of climate-related financial risks.

➺ Improved long-term strategic planning with integrated climate considerations.

5.5 Sustainable Value Creation (WEF): World Economic Forum

Overvew

Our Approach

Use the WEF framework to design strategies that balance economic growth with environmental and social responsibility.

Implement stakeholder engagement and materiality assessments.

Measure the impact of sustainability initiatives on both profitability and societal well-being.

Impact

➺ Improved decision-making and sustainable business models.

➺ Long-term growth that considers environmental, social, and economic dimensions.

➺ Enhanced brand reputation as a socially responsible company.