- Home

- About

- Industries Served

- Capabilities

- Digital Transormation

- Business Transformation

- Cyber Security

- Sustainability Strategy Advisory

- ESG Disclosures

- Net Zero Carbon

- Article 6 and Carbon Pricing

- Low Carbon Solutions

- Climate Reduction Regulatory Compliance

- Nationally Determined Contributions

- Contract Catalyst

- Accreditation Advisory

- Management System

- People Strategy

- GRC

- Case Studies

- Resources

- News

- Contact

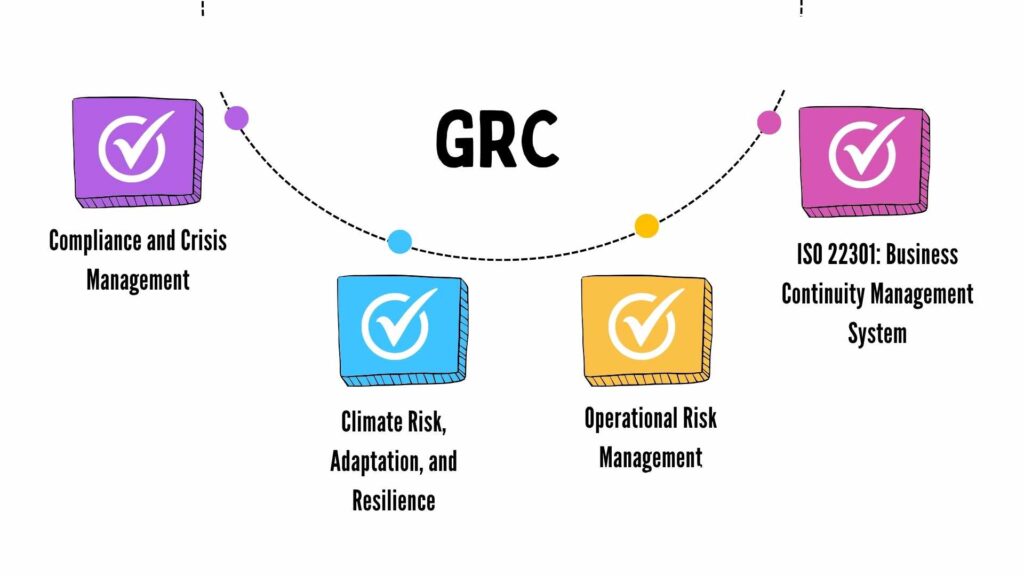

GRC

- Home

- GRC

Enhancing Organizational Resilience

GRC

Risk management and compliance can do more than mitigate threats and safeguard a company’s operations and reputation—it can create value. Our risk and compliance consulting team helps clients turn uncertainty into opportunity.

15.1 Compliance and Crisis Management

Overview

This service focuses on leveraging data-driven, technology-enabled solutions to optimize compliance risk management while prioritizing talent and corporate culture. We help organizations mature their compliance operations and navigate crises effectively, ensuring they remain resilient in a rapidly changing regulatory landscape.

Our Approach

Conduct in-depth risk assessments to identify compliance vulnerabilities.

Implement integrated risk management processes using technology to automate and streamline compliance activities.

Focus on building a strong organizational culture that embraces compliance, ethics, and rapid crisis response.

Use real-time data to support decision-making and crisis management protocols.

Impact

➺ Reduced compliance-related risks and penalties by ensuring adherence to regulatory requirements.

➺ Enhanced ability to respond to and manage crises effectively, reducing potential disruptions.

➺ Improved organizational culture around compliance, increasing trust and reducing potential legal and financial risks.

15.2 Climate Risk, Adaptation, and Resilience

Overview

Our Approach

Conduct climate risk assessments to understand the potential impact of environmental changes on the organization.

Integrate ESG principles into risk management frameworks to ensure sustainable practices.

Provide scenario analysis to help organizations prepare for climate-related risks.

Guide organizations in implementing sustainability initiatives that align with global net-zero goals.

Impact

➺ Improved climate resilience, reducing exposure to climate-related risks.

➺ Enhanced ESG compliance, increasing the organization’s sustainability credentials.

➺ Positive impact on long-term profitability through sustainable business practices.

15.3 Operational Risk Management

Overview

Our Approach

Conduct comprehensive assessments of operational risks across key business areas.

Implement risk management processes and controls to mitigate potential threats.

Establish clear policies and procedures to guide decision-making and compliance.

Train employees to recognize and address operational risks proactively.

Impact

➺ Reduced operational disruptions and enhanced risk controls.

➺ Lower likelihood of reputational damage and regulatory penalties.

➺ More efficient internal processes that align with risk management best practices.

15.4 ISO 22301: Business Continuity Management System

Overview

Our Approach

Risk Assessment & Gap Analysis

Identifying vulnerabilities and aligning current systems with ISO 22301 standards.

BCMS Design

Developing a tailored Business Continuity Management System (BCMS) to safeguard critical functions.

Business Continuity Plans (BCP)

Creating clear recovery procedures and roles during crises.

Training & Testing

Conducting training, workshops, and simulations to ensure readiness.

Continuous Monitoring & Improvement

Ongoing audits and updates to maintain resilience and compliance.

Impact

➺ Quick Recovery: Reduced downtime during disruptions.

➺ Compliance: Meets ISO 22301 and industry standards.

➺ Operational Stability: Minimizes risks and operational disruptions.

➺ Stakeholder Confidence: Builds trust with clients and partners through a structured continuity plan.