- Home

- About

- Industries Served

- Capabilities

- Digital Transormation

- Business Transformation

- Cyber Security

- Sustainability Strategy Advisory

- ESG Disclosures

- Net Zero Carbon

- Article 6 and Carbon Pricing

- Low Carbon Solutions

- Climate Reduction Regulatory Compliance

- Nationally Determined Contributions

- Contract Catalyst

- Accreditation Advisory

- Management System

- People Strategy

- GRC

- Case Studies

- Resources

- News

- Contact

Article 6 and Carbon Pricing

- Home

- Article 6 and Carbon Pricing

ARTICLE 6 and Carbon Pricing

Overview

Smart Sustain Transformation Consultancies L.L.C. specializes in guiding businesses through the complex landscape of carbon pricing, carbon markets, and sustainability initiatives. Our services empower organizations to reduce their carbon footprint, maximize carbon credit revenues, and navigate regulatory frameworks to meet global climate targets.

We provide:

- Expertise in carbon crediting and emissions reductions.

- Tailored solutions for carbon pricing mechanisms (e.g., voluntary markets, carbon offset projects, carbon taxes, and border carbon adjustments).

- Support in stakeholder engagement, ensuring projects align with social and environmental safeguards.

- Advanced carbon tracking tools and reporting services for accurate emissions reporting and compliance with global standards.

Let us help your organization reduce emissions and achieve sustainable growth in line with UAE’s and international climate objectives.

ARTICLE 6

Article 6 of the Paris Agreement lays down the foundation for cooperative approaches among countries to achieve their Nationally Determined

➺ Article 6 is an important part of the world’s “toolbox” for addressing climate change.

➺ It is the only part of the Paris Agreement that directly engages the business and private investment sector in directly implementable activities which they can invest in.

➺ There is strong real-world potential for cooperative action—shown by existing pilot Article 6 projects, with the UN decisions in Glasgow recognizing the impact of such actions on global mitigation.

➺ Many similar tools are being increasingly deployed at domestic, regional, and bilateral levels

➺ The centralized mechanism helps ensure broader accessibility of international carbon markets.

Types of Carbon Pricing and Smart Sustain Transformation consultancies role

| Type of Carbon Pricing | Description | Examples | Purpose | Role of Smart Sustain Transformation Consultancies L.L.C. (UAE) |

|---|---|---|---|---|

| Direct Carbon Pricing | Charges entities directly for their GHG emissions through market-based or fiscal tools. | Carbon Crediting Projects, Carbon Tax (if implemented) | To create financial incentives to reduce emissions. | Smart Sustain Transformation Consultancies L.L.C. provides strategic advice to UAE businesses on preparing for potential direct carbon pricing mechanisms. They support the design of emission reduction strategies and help organizations navigate voluntary carbon markets. |

| Carbon Crediting | Issues tradable credits for verified emission reductions or removals. | Afforestation, clean cookstove programs, renewable energy | Rewards voluntary emissions reduction and provides market value. | Smart Sustain supports UAE-based entities in designing, validating, and registering carbon crediting projects. They help navigate international registries and advise on selling credits in voluntary markets to generate climate finance. |

| Indirect Carbon Pricing | Applies taxes or subsidies on energy products, indirectly influencing emissions. | Fuel excise taxes, fossil fuel subsidies | Sends indirect price signals while meeting other policy goals. | Smart Sustain provides consulting on how UAE businesses can reduce cost exposure due to fuel price reforms or subsidy removal. They offer solutions like energy efficiency upgrades and fuel switching strategies. |

| Internal Carbon Pricing (ICP) | Applies a notional carbon cost to business operations to guide investment and planning. | Shadow pricing, internal carbon fees | Helps companies anticipate regulatory risks and align with ESG goals. | Smart Sustain helps UAE companies implement internal carbon pricing frameworks. They advise on setting shadow prices, allocating carbon budgets, and designing internal low-carbon investment plans. |

| Border Carbon Adjustments (BCA) | Applies carbon pricing to imported/exported goods to level the playing field internationally. | EU CBAM | Prevents carbon leakage and protects domestic industries. | Smart Sustain advises UAE exporters on CBAM compliance, including product-level carbon accounting, supply chain decarbonization, and strategies to minimize carbon costs in EU-bound exports. |

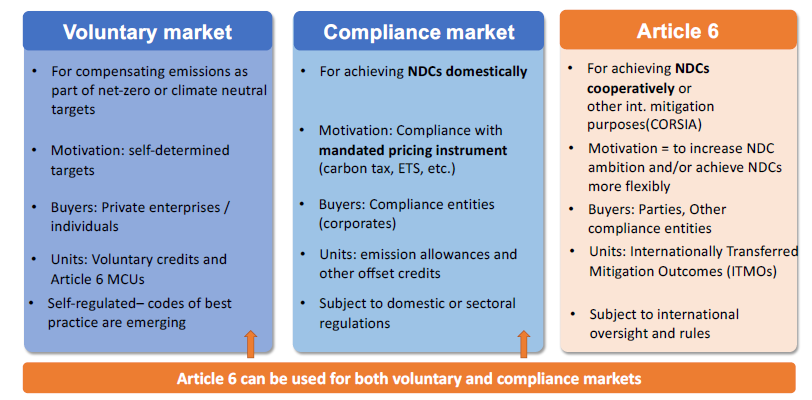

A. Voluntary Market

A1. Voluntary markets advisory – we provide advisory services on getting validated and verified through the following mechanism

➺ I. Verra

➺ II. Gold

➺ III. Others

A2. Key Component of VCMs for our advisory services

1. Project Development & Feasibility Studies

SSTC assists organizations in preparing carbon credit projects by conducting detailed feasibility studies to assess the potential for generating carbon credits. We evaluate the project’s scope, location, environmental impact, and financial viability. Our services include:

➺ Assessment of carbon offset potential and identification of carbon reduction opportunities.

➺ Analysis of project risks, costs, and expected revenue from the sale of carbon credits.

➺ Ensuring alignment with program-specific requirements, including those of Verra, Gold Standard, and national carbon registries.

2. Emissions Quantification & Baseline Analysis

We support businesses in conducting accurate emissions quantification and baseline analyses based on internationally recognized methodologies such as ISO 14064-2. We ensure that all calculations align with the requirements of relevant carbon credit programs.

➺ ISO 14064-2: For the quantification, monitoring, and reporting of GHG reductions from projects.

➺ Program-specific requirements (e.g., Verra, Gold Standard) for emissions quantification, including ensuring additionality, permanence, and leakage prevention.

➺ Development of a robust emissions baseline, which is essential for determining the project's emissions reduction potential.

3. Compliance with Carbon Credit Standards

Our team ensures that the carbon credit projects meet all the necessary compliance and regulatory requirements set by major carbon credit standards, such as Verra, Gold Standard, and national registries. We help prepare the project documentation and support the validation process, ensuring that:

➺ The project meets additionality criteria (ensuring reductions wouldn't have occurred without the project).

➺ The project has permanent, verifiable, and measurable emission reductions.

➺ The project aligns with the criteria for both environmental integrity and social responsibility, especially for projects in developing economies.

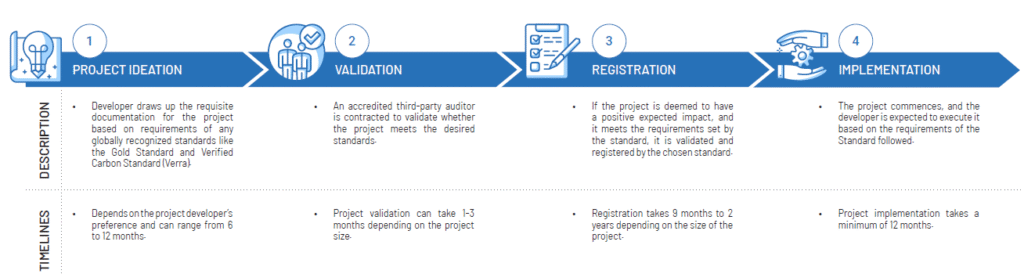

4. Carbon Credit Registration & Validation

Once the feasibility and emissions quantification are complete, we guide the project through the validation and registration process with the relevant carbon credit programs. Our support includes:

➺ Preparing project documentation for verification by third-party auditors.

➺ Submitting the project for registration with Verra, Gold Standard, or other recognized programs.

➺ Navigating the process of issuing carbon credits post-verification and registration.

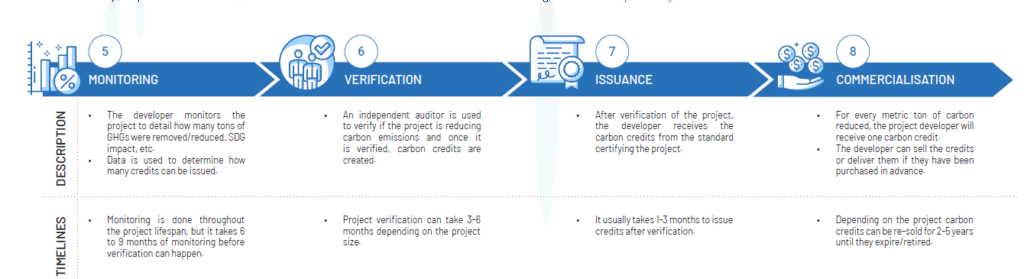

5. Ongoing Monitoring and Reporting

After the issuance of carbon credits, SSTC assists clients in implementing the monitoring and reporting requirements of the carbon credit program. This includes regular monitoring of the project’s performance and emissions reductions, ensuring that the credits remain valid over time and in compliance with the required standards.

Impact to Our Clients

Through SSTC’s Carbon Market Advisory services, clients gain the expertise and support necessary to not only purchase high-integrity carbon credits but also develop their own projects that contribute to measurable climate mitigation. By preparing their projects in line with global standards, organizations can:

➺ Generate high-quality carbon credits that meet the additionality, permanence, and verification requirements of industry-leading carbon credit programs.

➺ Ensure that projects are both financially viable and environmentally impactful, helping companies contribute effectively to global climate goals.

➺ Navigate complex regulatory and verification processes with ease, from feasibility studies to registration and post-issuance monitoring.

➺ Unlock new revenue streams from carbon credit sales while ensuring compliance with their broader net zero strategy.

➺ Support global decarbonization efforts, especially in developing countries, by financing projects that drive local sustainable development and climate action.

By working with SSTC, organizations ensure that their carbon credit projects are credible, impactful, and aligned with the latest standards, enabling them to make a meaningful contribution to the global fight against climate change.

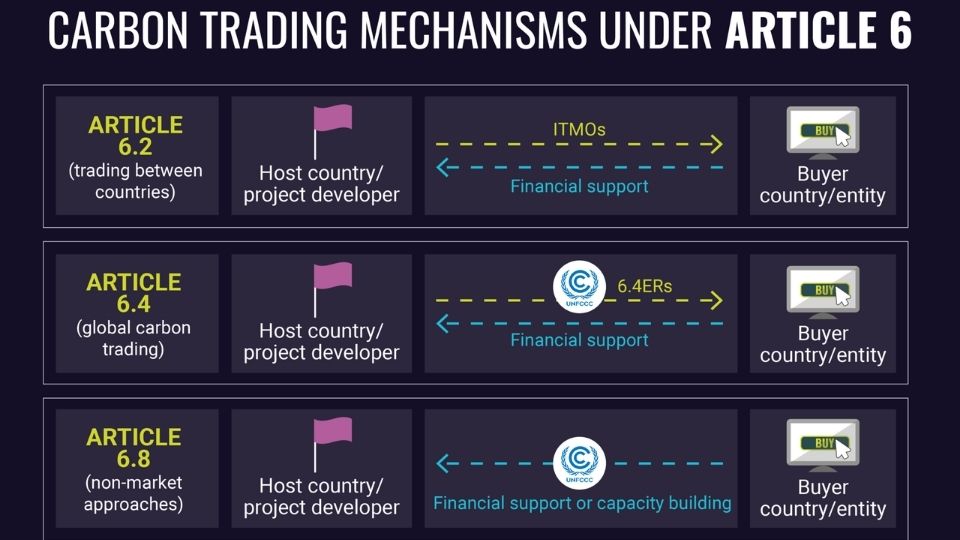

B. Compliance Market and Article 6.

Article 6.4 of the Paris Agreement establishes the Paris Agreement Crediting Mechanism (PACM), which allows for the creation and transfer of high-integrity carbon credits under UN supervision.Projects can generate credits by delivering verifiable, additional emission reductions, contributing to:

➺ UAE’s national targets

➺ International compliance obligations

➺ Corporate net-zero and sustainability goals

🔋 ELIGIBLE PROJECT TYPES UNDER ARTICLE 6.4

| Category | Example Methodologies/Tools | Eligible Activities |

|---|---|---|

| Renewable Energy | ACM0002, AMS-I.D. | Grid-connected solar, wind, hydro, geothermal |

| Thermal Energy Projects | AMS-I.C., AMS-I.E, AMS-II.G | Biomass, improved cookstoves, switch from non-renewable biomass |

| Landfill & Methane Capture | ACM0001, Tool on emissions from solid waste disposal, Tool on project emissions from flaring | Landfill gas capture, flaring, methane recovery |

| Energy Efficiency | Tool for baseline and leakage emissions, AMS-II.G, AMS-I.C. | Industrial and residential energy efficiency upgrades |

| Fossil Fuel Substitution | AMS-I.E, AMS-I.C., Tool for fossil fuel combustion emissions | Replacing fossil fuels with cleaner thermal alternatives |

| Transportation | Tool on project/leakage emissions from transportation of freight | Efficient logistics, low-carbon transport fuels |

| Biomass Projects | Tool for project and leakage emissions from biomass, fNRB tool | Sustainable forest biomass, agricultural waste usage |

| Solid Waste Management | Tool on emissions from solid waste disposal sites | Composting, landfill gas, incineration for energy |

| Electricity System Emissions | Tool to calculate emission factor for electricity system | All projects displacing grid electricity |

| Monitoring & Surveys | Sampling standards and guidelines for CDM | Monitoring, surveys, and sampling for PoAs (Programmes of Activities) |

Our Core Services

| Article 6.4 Advisory Services | UAE Carbon Registry Integration |

|---|---|

| Project feasibility studies | Liaison with UAE Designated National Authority (DNA) |

| Methodology selection and adaptation | Project endorsement for inclusion in national registry |

| Registration with the Article 6.4 Supervisory Body (UNFCCC) | ITMO authorization and corresponding adjustments |

| MRV (Monitoring, Reporting, Verification) design | Technical support in carbon credit tracking and reporting |

Each project will comply with approved UNFCCC methodologies or propose a new one.

WHY INTEGRATE WITH THE UAE NATIONAL CARBON REGISTRY?

The UAE National Carbon Registry is essential for:

➺ Tracking UAE-based carbon credits

➺ Facilitating ITMO transfers under Article 6.2

➺ Ensuring national transparency and accountability

➺ Preventing double counting of emission reductions

Smart Sustain helps you navigate national procedures, obtain project approval, and ensure your credits are registered, traceable, and tradable both locally and internationally.